rhode island tax table 2019

Rhode Island Division of Taxation One Capitol Hill Providence RI 02908 Phone. One Capitol Hill Providence RI 02908.

Pin By Explore My Journey On Uttarakhand Holidays 2019 Sightseeing Breakfast Buffet Uttarakhand

Rhode Island Bank Deposits Tax.

. Check the 2019 Rhode Island state tax rate and the rules to calculate state income tax. Find your income exemptions. Tax rate of 375 on the first 65250 of taxable income.

The Rhode Island tax rate is unchanged from last year however the. This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020. Calendar year 2018 Forms W-2 and RI-W3 Reconciliation of Personal Income Tax Withheld by Employers are due by January 31 2019.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales. The Rhode Island Department of Revenue is responsible for. Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax rates of 375 475 and 599 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

Rhode Islands income tax brackets were last changed one year prior to. CYE 2019 Partnership Income Tax Return to be filed by LLCs LLPs LPs and Partnerships. The Rhode Island State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Rhode Island State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

Find your gross income. IRA and Tax Tables 2019. Letha Fallis September 10 2015.

Find your pretax deductions including 401K flexible account contributions. Rhode Island Estate Tax. This means that these brackets applied to all income earned in 2018 and the tax return that uses these tax rates was due in April 2019.

According to the American Petroleum Institute the Ocean State has the 7th-highest tax on regular gas in the country. The tax on diesel is also 34 cents per gallon 9th-highest in the country. For more information on Rhode Island withholding tax call 1 401 574 8829 or see the Divisions website.

Rhode Island Alcohol Tax. A list of the 2019 withholding tax filing deadlines is available here. The Rhode Island Division of Taxation has released the.

Rhode Island Gas Tax. The Rhode Island State Tax Tables for 2019 displayed on this page are provided in support of the 2019 US Tax Calculator and the dedicated 2019 Rhode Island State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. 2020 Rhode Island Tax Deduction Amounts.

2019 IRA and Roth IRA Contribution Limits. How to Calculate 2019 Rhode Island State Income Tax by Using State Income Tax Table. 2022 Rhode Island Tax Expenditures Report 6 Summary Table by Tax Expenditure Category for 2019 Tax Expenditure Category 2 Number of Items in Each Category Tax Year 2019 Revenue Forgone Average Reliability Index Level Other Items 6 --- 50 Tax Deferrals 2 0 30.

Rhode Island Income Tax Rate 2022 - 2023. This excise tax totals 34 cents per gallon. Rhode Islands income tax brackets were last changed one year prior to 2020 for tax year 2019 and the tax rates were previously changed in 2009.

Find your income exemptions.

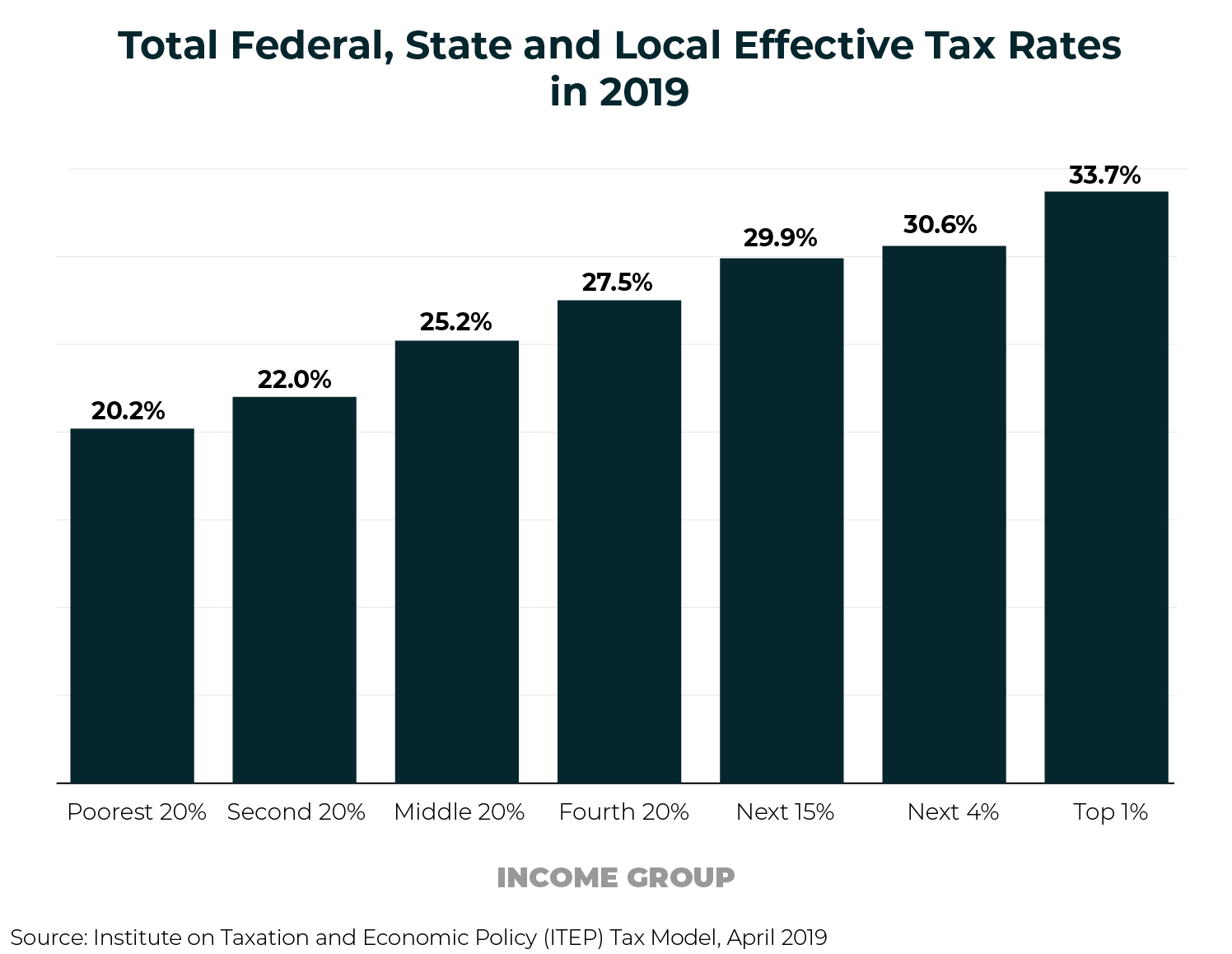

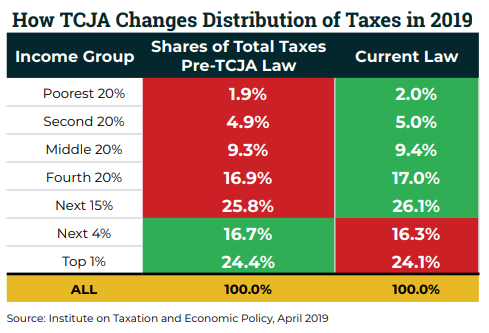

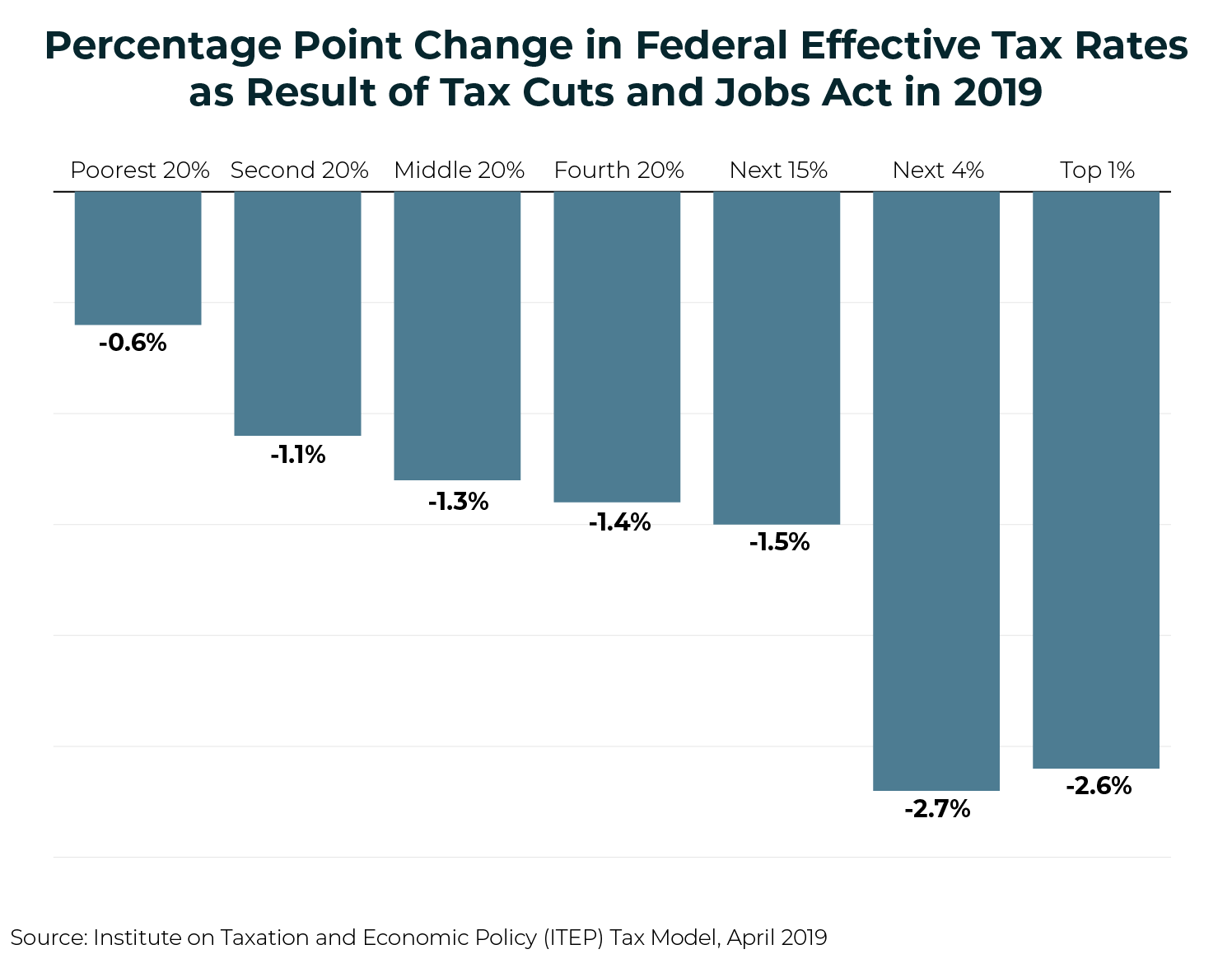

Who Pays Taxes In America In 2019 Itep

Investing In Real Estate Investment Trusts Reits Real Estate Investment Trust Investing Real Estate Investing

How Do State And Local Sales Taxes Work Tax Policy Center

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Canadian Cannabis Producers Overdue Excise Taxes More Than Triple To Ca 52 Million

Who Pays Taxes In America In 2019 Itep

Who Pays Taxes In America In 2019 Itep

Who Pays Taxes In America In 2019 Itep

Who Pays Taxes In America In 2019 Itep

Barry Ritholtz Author At The Big Picture Big Picture Weekend Reading Germany And Italy

Taxation Of Social Security Benefits Mn House Research

Profitable Giants Like Amazon Pay 0 In Corporate Taxes Some Voters Are Sick Of It The New York Times

Australia Tax Income Taxes In Australia Tax Foundation

Fall 2019 Perfect Cents Wallet Thirty One Gifts Thirty One Fall Thirty One

County Surcharge On General Excise And Use Tax Department Of Taxation

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Connecticut State Seal Connecticut Student Loan Forgiveness Seal