after tax income calculator iowa

After a few seconds you will be provided with a full breakdown of the tax you are paying. If you make 119500 in Iowa what will your salary after tax be.

Iowa Paycheck Calculator Smartasset

Annual Income for 2022.

. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Your average tax rate is 208 and your marginal tax rate is 345. To use our Iowa Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Youll then get a breakdown of your total tax liability and take-home pay. Taxable Income in Iowa is calculated by subtracting your tax deductions from your gross income. Your average tax rate is 1871 and your marginal tax.

Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS next April. Simply enter your annual or monthly income into the tax calculator above to find out how US taxes affect your income. Our Iowa State Tax Calculator will display a detailed graphical breakdown of the percentage and amounts which will be taken from your 20000000 and go towards tax.

If you make 70000 a year living in the region of Iowa USA you will be taxed 14177. Salary Before Tax your total earnings before any taxes have been deducted. 163800 - 0 - 327600 067.

Appanoose County has an additional 1 local income tax. Far too many people fail to allow for the full income tax deduction allowances when completing their annual tax return inIowa the net effect for those individuals is a higher state income tax bill in Iowa and a higher Federal tax bill. If you make 55000 a year living in the region of Iowa USA you will be taxed 11457.

Your average tax rate is 217 and your marginal tax rate is 360. This marginal tax rate means that your immediate additional income will be taxed at this rate. Your average tax rate is 1198 and your marginal tax.

Tax Rate Threshold Tax Due in Band. That means that your net pay will be 43543 per year or 3629 per month. Iowa Income Tax Calculator 2021.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. For instance an increase of 100 in your salary will be taxed 3601 hence your net pay will only increase by 6399. While this calculator can be used for Iowa tax calculations by using the drop down menu provided you are able to change it to a different State.

Switch to Iowa hourly calculator. The annual income calculation used in this calculator is based on your hourly wage the number of hours that you work per week and the amount of paid time off that you have per year. Iowa State Tax Calculation for 50k Salary.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. This allows you to find out your annual. Iowa Income Tax Calculator 2021.

Many of Iowas 327 school districts levy an income surtax that is equal to a percentage of the Iowa taxes paid by residents. If you make 170000 a year living in the region of Iowa USA you will be taxed 46128. How Income Taxes Are Calculated.

State Income Tax Total from all Rates. So if you pay 2000 in Iowa state taxes and your school district surtax is. Our income tax and paycheck calculator can help you understand your take home pay.

0 - 163800 033. Using our Iowa Salary Tax Calculator. Also known as Gross Income.

1040 Tax Calculator Enter your filing status income deductions and credits and we will estimate your total taxes. 327600 - 0 - 655200 225. Our Iowa State Tax Calculator will display a detailed graphical breakdown of the percentage and amounts which will be taken from your 12500000 and go towards tax.

Iowa State Tax Tables. This marginal tax rate means that your immediate additional income will be taxed at this rate. 332 rows calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income understand your tax liability Taxable income Tax rate Tax liability minus any additional tax withholdings Total annual income Tax liability All deductions Withholdings Your annual paycheck.

While this calculator can be used for Iowa tax calculations by using the drop down menu provided you are able to change it to a different State. Personal Exemption Tax Credit for Iowa 4000 4000. Calculate your Iowa net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Iowa paycheck calculator.

Your gross annual income which is your income before tax is deducted is then adjusted by your states income tax to get your net annual after-tax income. Your household income location filing status and number of personal exemptions.

You May Not Want To Hear How Much Money You Have To Make To Live In Northern California

1 500 After Tax Us Breakdown July 2022 Incomeaftertax Com

![]()

Iowa Income Tax Calculator 2022 With Tax Brackets And Info Investomatica

Tax On Rental Income Calculator Tips Wowa Ca

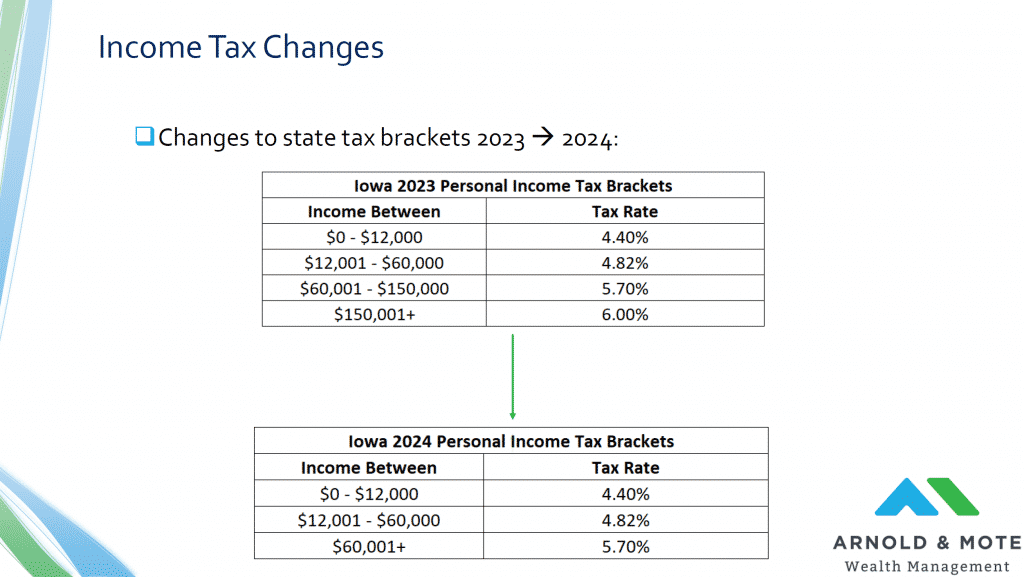

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

How Is Tax Liability Calculated Common Tax Questions Answered

How Is Tax Liability Calculated Common Tax Questions Answered

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

State Corporate Income Tax Rates And Brackets Tax Foundation

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020

Understanding Progressive Tax Rates Ag Decision Maker

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Income Tax Calculator Estimate Your Refund In Seconds For Free

Understanding Progressive Tax Rates Ag Decision Maker

In Iowa Your Taxes Help Corporations Not Pay Theirs Caffeinated Thoughts Tax Help Tax Forms Business Tax

How Do State And Local Individual Income Taxes Work Tax Policy Center

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)